Photo: vision China

Layman's assessment of prospects for China's economy to diverge. Morgan Stanley recently raised expectations of economic growth in China, its forecast for China's economy than other Wall Street institutions and IMF are optimistic. Finance local and immediate interests should never

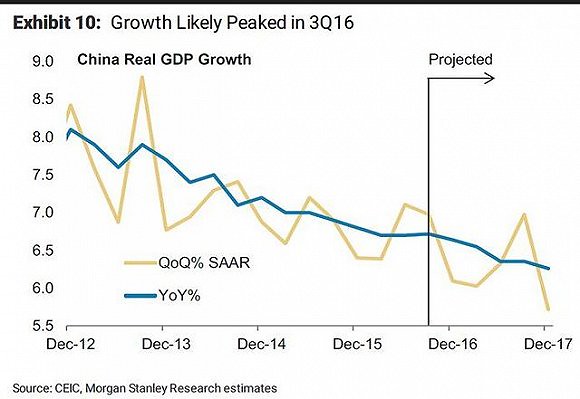

Last week, Morgan Stanley's greater China Chief Economist XING Ziqiang, analysts expected a report released, China's GDP this year and next will be 6.7% and 6.4% respectively, higher than an earlier estimate of 6.4% and 6.2%. Report says

New expectations "is slightly higher than Wall Street's consensus expectations, mainly reflects the strong financial support will bring periodic growth momentum, as well as stronger-than-expected external demand. "

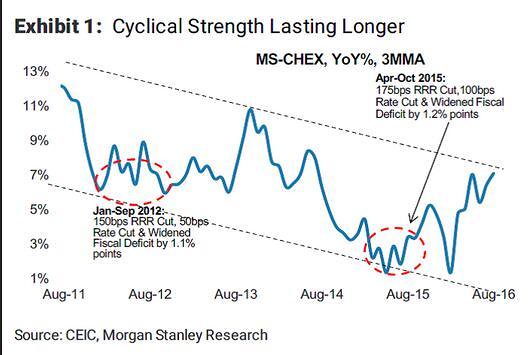

Report, for structural reforms to make the Chinese Government adjustment means that domestic economic growth were accelerating the decline trend. But policies can affect the cycle, the current cycle will benefit from Government initiatives such as the expenditure last year.

In particular, investment and stronger auto sales will help to maintain the cycle of growth again, last longer than Morgan Stanley previously had expected. In the United Kingdom referendum returned to Europe, Morgan Stanley expected recovery in external demand than the strong.

However, Morgan Stanley predicted in the third and fourth quarters of this year after growth of 6.7% and 6.6%, respectively, China's economic expansion will slow from next year, possibly quarterly growth rate peaked in the third quarter of next year.

Given the auto sales are likely to decline, policy support for the housing market activity may be reduced next year as a whole will be gradually eased. In the long term, high debt and weak productivity these negative structural factors will put downward pressure on growth.

Compared with other Wall Street forecast Morgan Stanley's expected high economic growth in China. Bloomberg News survey forecast of 58 economists have showed that China's GDP this year will grow 6.6%. Bloomberg also mentioned twice within three months, Deutsche Bank has cut its China growth forecast.

Last week the IMF announced that the latest Economic Outlook, China's economic growth this year and next is expected 6.6% and 6.2%. While the expected growth is flat with the last Outlook report, but the economic growth rate to be established on the basis of China's successful transition, service and consumer needs to boost growth, more sustainable long-term economic expansion.

IMF report also noted that China's debt issue, saying China's debt expanded at a dangerous speed. IMF calls on the Chinese Government to take measures to control credit expansion. For a State-owned enterprise cannot survive, IMF says China should stop their support of the Government.

Source: Wall Street stories

Original title: promising policy support for Morgan Stanley to raise China's economic expectations

More news, more reports, please go to the App store search for a download "screen press", or click on the link

No comments:

Post a Comment